Форекс-брокер реализует прогрессивную систему инвестирования с привлечением PAMM провайдеров. PAMM – возможность следовать стратегии инвестиций профессионального трейдера, получая установленную прибыль. Новичкам на форекс рынке предусмотрен демо-счет, с помощью которого возможно попробовать свои силы в трейдинге и заодно ознакомится с функционалом личного кабинета. Обращаем ваше внимание, что для повышения качества обслуживания торговых счетов в платформах MetaTrader… Самое важное при выборе форекс брокера – это определить, какие параметры интересуют именно вас. Мы рекомендуем ознакомиться с подробным руководством, описывающим универсальный метод выбора Forex-брокера.

Не скажу, что сразу и самостоятельно разобрался — там такое количество разных настроек и ограничений, но, по крайней мере, это шаг вперед в моем развитии. А в настройках еще планирую разобраться, их вполне можно подстроить под свои потребности, и еще в конкурсе управляющих выиграть. markets60 является действующим членом финансовой комиссии. Мы зашли на сайт саморегулируемой организации и выяснили, что она не зарегистрирована в качестве арбитражного надзорного органа какой-либо юрисдикции. Другими словами, FinaCom PLC LTD не гарантирует возмещение денежных средств при возникновении конфликтной ситуации. На нашем веб-сайте вы можете увидеть, что некоторые пользователи сообщают о мошенничестве.

на форекс с

Сервис автоматического трейдинга на основе проверенных торговых стратегий. Пользователь получает доступ к сигналам от опытных специалистов, которые доказали свою эффективность. Интернет-платформа, которая позволяет организовать автоматическую торговлю на основе сигналов от реальных трейдеров.

- Чтобы определить безопасность наших ведущих брокеров, наши эксперты учитывают множество факторов.

- В своем отзыве Виктор поведал о долгом поступлении средств на счет.

- По депозиту и выводу, как и у многих хороших брокеров, Global Prime предоставляет подробную форму с важной информацией о валюте, способе оплаты, минимальной сумме, дате прибытия, сборах и т.

- Сумма рассчитывается по стандартной комиссии со сделок и зависит от суммарной маржи по закрытым позициям реферала за 90 дней.

- По депозиту и выводу, как и у многих хороших брокеров, markets60 предоставляет подробную форму с важной информацией о валюте, способе оплаты, минимальной сумме, дате прибытия, сборах и т.

Кроме того, здесь можно получить бездепозитный бонус – 1$ на Micro счет или 10$ на STP счет. Бонус является неснимаемым, но прибыль, заработанную с его помощью, можно выводить в полном размере при выполнении всех условий. Попробовал торговлю на 10 долларов, которые получил в качестве приветственного бонуса от брокера. В итоге я все слил, потом решил свои деньги положить. После пополнения счета стал торговать, вот там уже результат увидел.

markets60 AU Pty Ltd

Как видно на скриншоте ниже, у брокера множество сайтов разных юрисдикций, например в Великобритании и Австралии. Обсудим сомнительные моменты, которые мы выявили в ходе анализа брокерской площадки. Нельзя безрассудно регистрировать счет, ведь выбор финансовой компании требуют многогранной оценки. На сайте владельцы markets60 разместили отзывы с площадки trustpilot.com.ru. Клиенты ставят брокеру оценку 4,2 балла из 5 возможных. У каждого варианта своя комиссия при пополнении и выводе.

- Как видно на скриншоте ниже, у брокера множество сайтов разных юрисдикций, например в Великобритании и Австралии.

- Подробности можно узнать на официальном сайте markets60 или в Личном кабинете на портале после открытии счета.

- Это касается и торговых операций, и вывода средств, и работы саппорта.

- С помощью этого сервиса можно управлять несколькими торговыми счетами, создавать диверсифицированный портфель инвестиций.

- В markets60 средний спред для валютной пары EUR/USD составляет — пипса, а в global-prime – 0.4.

Из плюсов платформы можно выделить демо-счет, небольшой порог входа и ECN-технологию. Как мы помним, торговать можно только у того брокера, который получил лицензию. https://markets60.live/ Как пояснил менеджер в чате, у markets60 Markets Limited нет регуляции, есть только регистрация, хотя другие компании из международной группы регулируются FCA и ASIC.

Низкие комиссии

Перевод пришел через 5 дней, хотя у других компаний этот срок меньше в два раза. Сама торговля была негодной вне зависимости от выбранного инструмента. Возможно, админы markets60 подстраивают слив депозита под видом неудачного закрытия сделок. В нашей стране лицензии брокерам выдает Центральный Банк. Однако markets60 работает в обход закона, за что попал в черный список на портале регулятора.

Чтобы определить безопасность наших ведущих брокеров, наши эксперты учитывают множество факторов. Это включает в себя лицензии, которыми владеет брокер, и надежность этих лицензий. Мы также учитываем историю брокеров, потому что долгосрочные брокеры обычно более надежны и заслуживают доверия, чем новые брокеры. По депозиту и выводу, как и у многих хороших брокеров, Global Prime предоставляет подробную форму с важной информацией о валюте, способе оплаты, минимальной сумме, дате прибытия, сборах и т.

После 1970-х годов, когда Соединенные Штаты отказались от Бреттон-Вудского соглашения о конвертируемости доллара США в золото, валютный рынок резко вырос. Сначала он был доступен только институциональным игрокам из-за высоких транзакционных издержек и сложности доступа, но все изменилось с появлением Интернета и онлайн-трейдинга. Форекс брокеры позволили розничным трейдерам присоединиться к крупнейшему финансовому рынку в мире.

Форекс-брокер не обеспечивает возможностью трейдинга для жителей США. Рекомендуется проанализировать и подсчитать предполагаемые риски в ходе торговли активами. Следует неоднократно ознакомиться с обучающими материалами и тематической литературой, нивелируя риски полной потери капитала.

Информация и анализ рынка на этом сайте содержат общую информацию, подготовленную для всех наших клиентов, без учета их личных целей, финансового положения или потребностей. Поэтому вам следует рассматривать такой общий совет с учетом markets60 ваших собственных целей, финансового положения или потребностей, прежде чем следовать ему. markets60 EU Ltd – CFD являются комплексными инструментами и сопряжены с высоким риском быстро потерять деньги из-за кредитного плеча.

Поэтому я решил, что поменяю брокера, будет быстрее и проще в работе. Хотя кроме того, что тут все долго, я недостатков не обнаружил. Форекс брокер markets60 не самый известный, но мне понравился. Начала торговать с компанией с бездепозитным бонусом $10.

Обзор форекс-брокера markets60

Подумайте, чего вы хотите добиться от этого и как вы лично определяете успех. Постановка целей жизненна важна, и более того, они должны быть легко измеримы. Мы рекомендуем поставить цель, которая может быть достигнута через длительный период времени, например через год, а не месяц. Как только вы определите эти факторы, вы сможете успешно применить свой план. Независимо от вашего опыта, важно всегда управлять ожиданиями на протяжении всего процесса торговли на Форекс, а также контролировать свои эмоции. Чтобы стать успешным трейдером, вы должны понимать механику рынка форекс, доверять своему анализу и следовать торговым стратегиям.

Остальные торговые инструменты будут торговаться в обычном режиме. Чтобы получить полное представление о том, насколько дешевы или дороги markets60 и global-prime, мы сначала рассмотрели общие сборы для стандартных аккаунтов. В markets60 средний спред для валютной пары EUR/USD составляет — пипса, а в global-prime – 0.4. В настоящее время мы не получали никаких сообщений о мошеннических действиях.

С 1 сентября 2013 года Fx Open зарегистрирован в Международной Финансовой комиссии (The Financial Commission). Организация рассматривает претензии клиентов к брокерам. Если они обоснованы, трейдер может рассчитывать на компенсацию в сумме до 20 тысяч евро. markets60 ведет деятельность более 11 лет и полностью регулируется с помощью FCA и ASIC, результат надежности которого я увидел в реальности. Также спреды на основные пары минимизированы, исполнение торговых сделок происходит почти мгновенно, без сбоев и технических проблем.

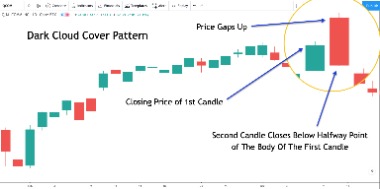

Торговые стратегии

Вы будете заняты только перепиской с ними, на что-то полезное типа торгов и аналитики, времени просто не останется. Минимальная сумма для вывода варьируется от 1 до 100 долларов (в долларах или евро). Длительность обработки заявки на вывод колеблется от 1 до 3 рабочих дней. В разделе «История операций» отображается статус заявки на английском языке.

Компания markets60 Markets Limited зарегиcтрирована на территории Невиса (регистрационный номер компании 42235). markets60 является членом международной финансовой комиссии The Financial Commission. В дополнение к новой линейке типов счетов, markets60 готовится к запуску новых функций и обновлению своих предложений. В компании уверены, что у пользователей появится еще больше причин сотрудничать с брокером номер 1 в мире. Эти факторы должны еще больше укрепить markets60 как одного из приоритетных брокеров для трейдеров, ищущих передовые технологии, конкурентоспособные цены и первоклассное обслуживание.