Content

They represent the opening and closing prices of a currency pair and the peak and low prices for a specified time period. Price ranges are represented by vertical lines in bar charts, with the opening price indicated by a horizontal line on the left and the closing price indicated by a horizontal line on the right. To read a candlestick chart, you should focus on the size and color of the candlesticks. A large green candlestick indicates a strong price movement to the upside, while a large red candlestick indicates a strong price movement to the downside. You can also use candlestick charts to identify important levels of support and resistance. These levels are indicated by horizontal lines drawn across the chart at key price points.

Indicators are used to analyse market trends and predict future price movements using mathematical calculations based on price and/or volume data. Examples include Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the Fibonacci retracement tool. It represents the closing price, opening price, high price, and low price of a currency pair. This makes it easier for you to see the entire price range of the pair for the defined time period in one go. Reading and understanding forex trading charts is a crucial skill for successful forex trading.

Latest Article

This is helpful because it means there must be a clear and pronounced change in price before it is marked on the chart. All in all, this type of chart is less detailed but also easier to understand than a tick chart and gives you a broad overview of a currency pair’s movement. A forex chart shows changes in the exchange rate of a currency pair over time. Support and resistance levels are areas where price movements are likely to pause or reverse. Support levels indicate a surplus of buyers, whereas resistance levels indicate a surplus of sellers. Support levels are areas where buying pressure is strong enough to prevent prices from falling further.

Once the graph has been generated, you will have to see the lines plotted on the graph as whole. There would be several ups and downs as you move along the X-axis that will help you in determining the overall trends of the currency pair. So let’s look at the steps below in which you can read the main types of trading charts if you are new in the field. It is recommended that you should give all kinds of Forex charts a try, after which you can decide which Forex chart suits your needs & requirements the best.

The highest point at the top of the wick or the Upper Shadow point shows the highest exchange rate for the given currency pair. The lowest point at the bottom or the Lower Shadow point shows the lowest price for the given currency pair. This is the only solution that will be able to make you successful. You need to move on quickly to move towards success when it comes to learning how to read different types of forex charts. Can you not use the information published on the internet, or watch YouTube analysis videos to help you?

When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. AxiTrader is not a financial adviser and all services are provided on an execution only basis. Information is of a general nature only and does not consider your financial objectives, needs or personal circumstances.

What is a Swing Trade in Forex: Essential Guide for Traders

For example, to find the average price for the week, you would add up the closing price for each day and then divide the sum by seven. These averages are helpful because they can help determine the support and resistance prices for a currency pair. If the body is filled in, the closing price was lower than the opening. If it’s not filled in, the closing price was higher than the opening.

- Forex charts can look drastically different depending on what options you want to use.

- Now that you know why candlesticks are so cool, it’s time to let you know that we will be using candlestick charts for most, if not all, of the chart examples on this site.

- Traders watch the volume behind a price movement to determine if it’s backed by conviction or lack thereof.

- Technical analysis is the review of past market prices and technical indicators to predict the future movements of an investment.

- Candlestick charts indicate the high-to-low price range of the currency pair with a vertical line.

- A trading activity chart shows the current Forex currency pair quotes (in our example, how much is 1 euro in US dollars).

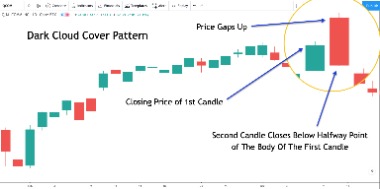

Candlesticks are good at identifying market turning points – reversals from an uptrend to a downtrend or a downtrend to an uptrend. A very detailed comparison of the Japanese candlestick chart and the Renko chart is here. The brick size represents how much the price should change to draw a Renko candlestick in the chart. Area Forex chart clearly shows price changes in relation to the previous period. If you need to remember the price chart, then an area chart is an ideal choice. Now let’s look at the more complex and rarer types of Forex chart displays.

Although it is not a must know theory, most technical analysts have an idea of how to utilize this theory when analyzing the market cycles. To read a line chart, you should focus on the direction of the line. If the line is moving up, the currency is appreciating, and if the line is moving down, the currency is depreciating.

Types of Forex Charts

Logically, the chart tells you when it is time to buy and when it’s time to sell. Although the pandemic has decimated the world’s economies, the forex market has never felt better—we have seen 300% growth in trading accounts since the outbreak began. Needless to say, there is more opportunity here than ever, but only for those with forex literacy. But let me tell you something, some of the most successful retail traders believe that the best methods in Forex trading are the more simple ones.

Like all things in life, the more you practice, the more you enhance your skills. This article aims to kick you off on your journey to understanding and using charts to enhance your trades. They prefer to follow the predictive powers of charting tools and indicators to identify peaking trends and price points, in order to guide them when to enter and exit the markets. Let’s start by understanding what a trading chart is, before zooming in on patterns and indicators. In short, a chart is a depiction of exchange rates that happen between two financial instruments that are plotted and illustrated on a graph. That’s why this type of chart is usually used to get the bigger picture view of price movement.

Nowadays, traders can see the charts for any time period and for any financial instrument on the computer screen. But the Forex charts are drawn according to the same principles as in the past. For example, if the candle’s body is short, but the wick is long, it could mean there was a lot of pressure in one direction but it was pushed back before close. Because tick charts are transaction-based, rather than time-based, they might better illustrate the interest in a particular currency pair than it’s price history. Several upward ticks may suggest a possible uptrend, making these charts useful when you’re deciding whether to buy or sell.

Trading with Forex Line Charts

All it shows is that the price of a currency pair or any other asset closed at X at the end of the period. Double bottom is a reversal pattern that indicates the completion of a downtrend. It is the opposite of the double-top pattern and consists of two roughly equal-depth troughs separated by a peak. The pattern is complete when the price breaks above the resistance level represented by the peak. Head and shoulders is a reversal pattern that indicates the conclusion of an uptrend.

Made up of a sequence of vertical lines where each line is a representation of trading information. They do represent the highs and low https://g-markets.net/helpful-articles/dollar-regains-appeal-in-carry-trades/ of the trading period as well as the open and closing price. The open and the close price are represented by a horizontal shorter line.

In this case, there is a strong possibility of a downward trend to follow. Another bad omen, the so-called shooting star, is indicated by a small candle body, large upper wick, and little to no lower wick. This means the candle body will appear near the bottom—a shooting star is also known as an inverted hammer for obvious reasons. Thus, these X and O marks are not made on the chart unless the price rises or falls enough to justify making a mark. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com.

One of the best Forex courses you will find on the internet is Asia Forex Mentor’s Ezekiel Chew. This course by Ezekiel Chew is one of the highest-rated Forex courses on the internet primarily because it is informative, and it has helped thousands of aspiring Forex traders. Point and figure chart is probably the most popular & most used trading chart used for Forex trading.

It was not basically a chart, rather it was forecasting method, using point and figures. Most price charts, utilized in the modern analysis, are constructed based on the opening price, closing price, high and low during a particular time period. But the point & figure chart is constructed based on just the closing price for the period. Point and figure charts are characterized by a series of Xs and Os. The Xs represent upward price trends and the Os represent downward price trends. Each box on the chart represents the price scale, which adjusts depending on the price of the instrument.

In theory, a price shouldn’t go over the resistance line or below the support line—if it does, it won’t stay there for long, so be prepared to buy or sell should that happen. Some patterns will indicate a bullish sentiment, and here is the most prominent example. A hammer is just the inverse of a shooting star—in other words, sellers pushed the price to a low during the day before sellers pushed it back up.

There are theories about using candlestick patterns to predict the price. Candlestick analysis is said to provide a nearly instant sentiment read on the market. Daily charts are typically used by traders who are seeking to implement swing-trading strategies. These strategies seek to gain the bulk of profits over significant short to medium price changes in the markets. The time horizon for swing trades ranges from a few days to a few months.

Forex chart analysis

Learning how to read a forex chart is considered to be somewhat of a science. Forex charts can look drastically different depending on what options you want to use. Charts usually have settings for the display style of the price and the time frame that you want to view. Time frames can be anywhere from 1 second to 10 years, depending on the charting system.